has negotiated tax treaties (see below) may be able to reduce the amount of tax on their scholarships. Individuals from countries with which the U.S. If your scholarship is from sources inside the United States, the portion of your scholarship used for room and board as well as for other non-educational expenses is taxed at a flat rate of 14% (or 30% if you have no U.S. What is my tax obligation for that scholarship? Contact if you have questions about your tax residence status. and for J-1 scholars who have visited the U.S. Researcher does not pass the SPT for 2022 and must file a nonresident tax return for 2022.ĭetermination of tax residence status is more complex for F-1 and J-1 students who have previously visited the U.S. His total of 153 days is less than 183, so Dr. (100% of the days he was present in his third year, 2022) (20) when taking the Substantial Presence Test, so his calculation is as follows: As a J-1 scholar he cannot count any time during his first 2 years in the U.S. as a J-1 Short-Term Scholar on August 1, 2022. He returned home in May 2021, then came back to the U.S.

for the first time as a J-1 Research Scholar from June 2020 through May 2021.

He will file his taxes for 2022 using the same forms and rules that apply to U.S. Student passes the SPT for 2022 and is considered a resident for 2022 U.S. (2016 through 2020) when taking the Substantial Presence Test, so his calculation is as follows: As an F-1 student he cannot count any time during his first 5 years in the U.S. for the first time since 2016 on May 20, 2022, to visit his family for the summer and study abroad in China for Fall Semester 2022. in F-1 student status on August 10, 2016, and has maintained that status. J scholars can count days for the Substantial Presence Test only for years after their first 2 years in the U.S.Įxcellent Student arrived in the U.S. Remember that F and J students can count days for the Substantial Presence Test only for years after their first 5 years in the U.S. as a J scholar, then you are a resident for tax purposes in 2022 and can file the same as an F or J student and not counting any days in the first two calendar years you were present in the U.S. If the total of this calculation is 183 or greater, not counting any days in the first 5 calendar years you were in the U.S.

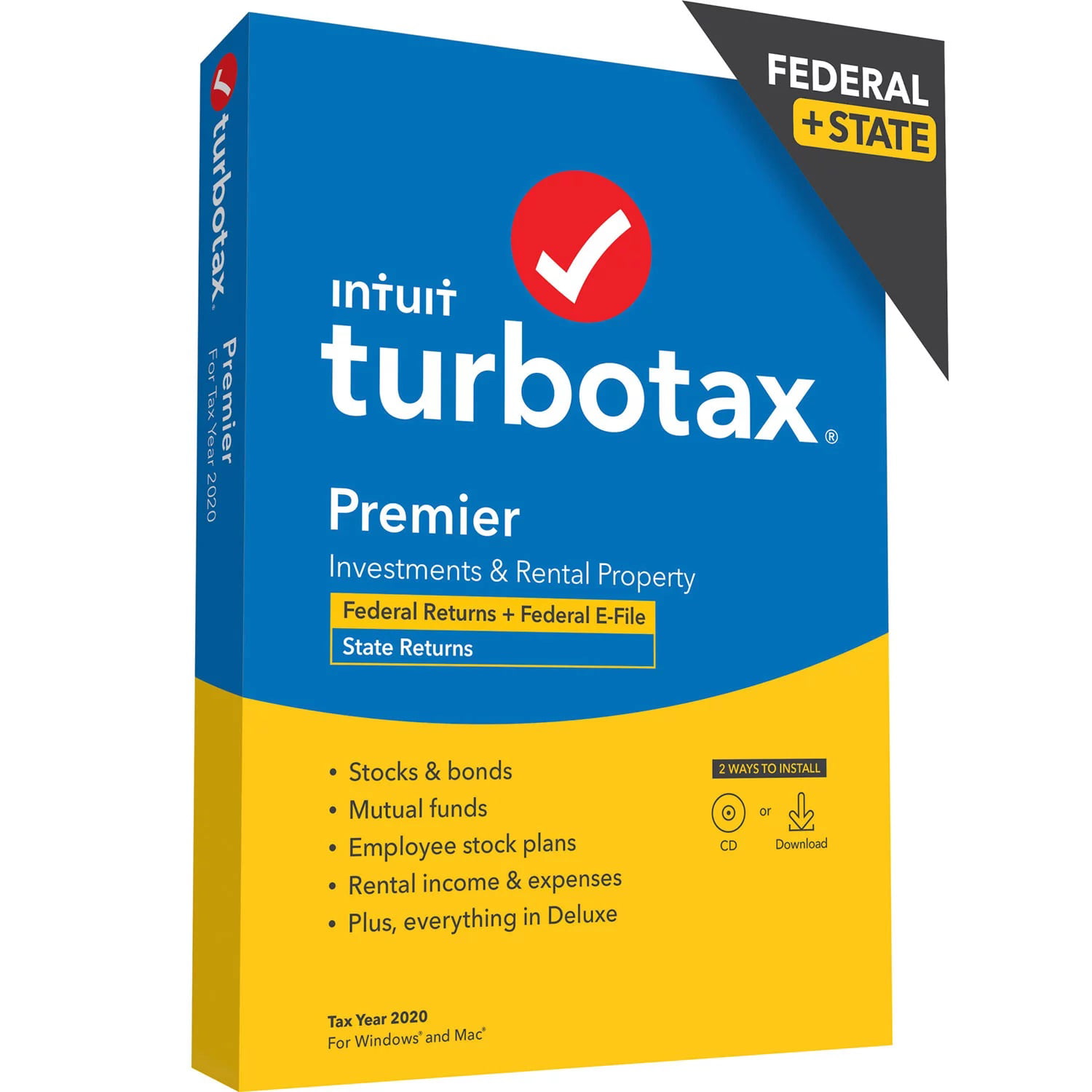

TURBOTAX CALCULATOR FOR F1 STUDENT FULL

(Note that partial years count as full years for this calculation.) If you are an F-1 or J-1 student who came J-1 scholars are nonresidents for their first two years. How do I know if I am a resident or a nonresident for tax purposes?į-1 and J-1 students are nonresidents for tax purposes for their first five years in the Tax formsĪnd rules are different for residents and nonresidents and it is very important to file theĬorrect forms to avoid legal and financial difficulties. That depends on if you are a resident or nonresident for tax purposes. government will not accept 2022 tax returns for processing until January 23, 2023. The 2022 State of Iowa tax return filing deadline is May 1, 2023. government) tax returns are due by April 18, 2023.

0 kommentar(er)

0 kommentar(er)